Challenges for small business owners are widespread in 2023 –– inflation pressure, labor shortages, supply chain disruptions, and recession threats are just a few. Some small businesses are still navigating the aftermath of COVID-19. Some are boosting their web presence and incorporating AI into their business strategies to drive growth. What they’ve all done is shown remarkable resilience.

To understand the state of small businesses in 2023, Coast surveyed a diverse set of small business owners across the United States as well as analyzed small business employment data from the U.S. Bureau of Labor Statistics (BLS).

In this study, we’ll answer the following questions and more:

- How long did it take small businesses to bounce back after COVID-19?

- How did small business employment recover, state by state after COVID?

- How are small businesses retaining employees during a labor shortage?

- Are small business owners raising their prices in response to inflation?

Small Business Recovery in the Aftermath of COVID

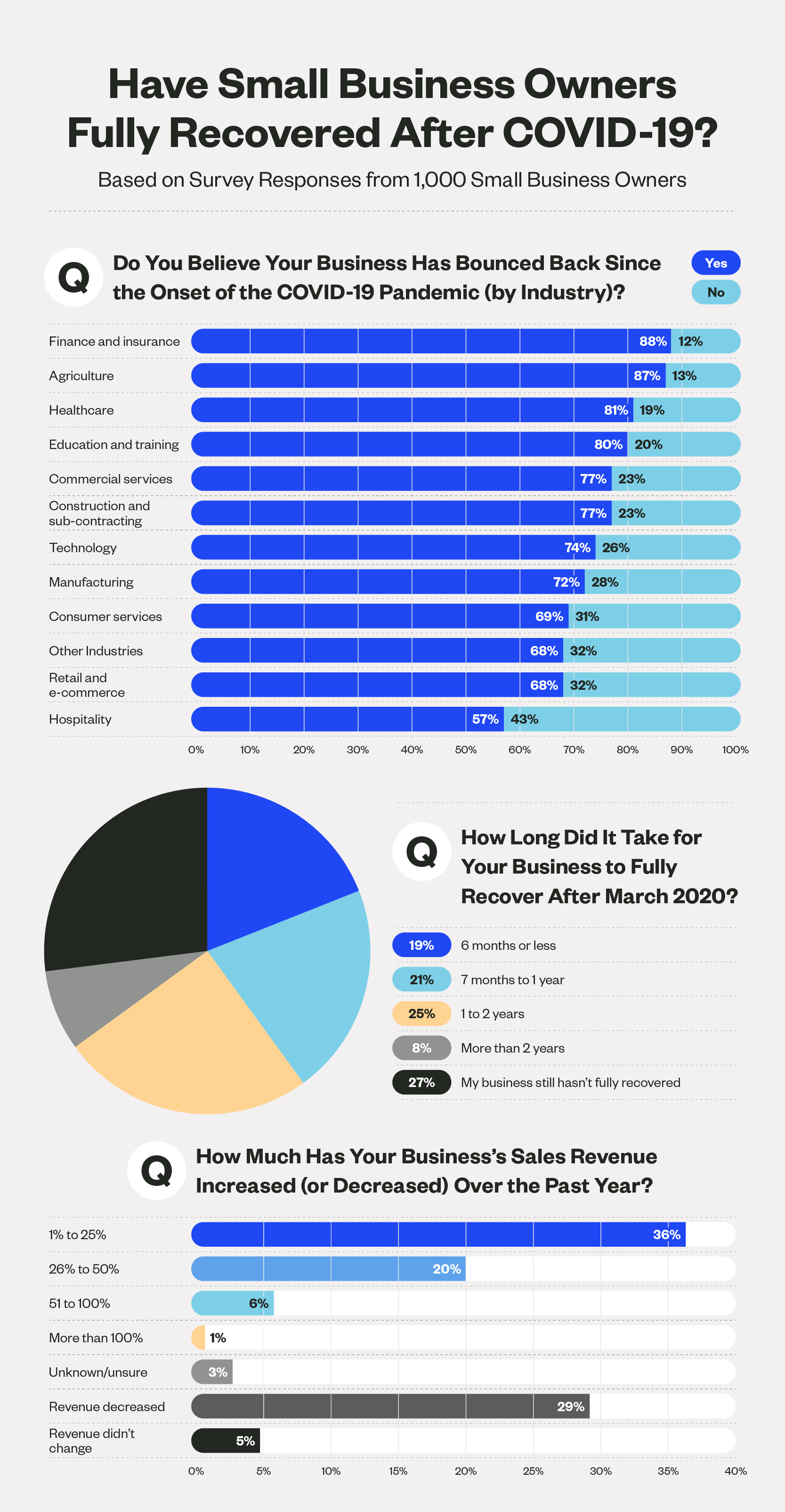

The impact of COVID-19 on small businesses has been substantial. A quarter of small business owners (25%) report that it took them one to two years to fully recover after the outbreak. An additional 27% revealed that their businesses still have not fully recovered, indicating an ongoing struggle for some owners.

When looking at the recovery rates by industry, it’s evident that small businesses in finance, insurance, and agriculture show the highest bounce-back rates. 88% of owners in the finance and insurance sectors and 87% of owners in agriculture report that their businesses have fully bounced back since the pandemic.

In contrast, the hospitality, retail, and e-commerce sectors are experiencing a more challenging road to recovery, with only 57% and 68% of small business owners in these sectors, respectively, reporting a successful comeback.

In terms of sales revenue, small businesses have seen mixed outcomes. Around 63% of small business owners saw their sales revenue grow over the past year. The largest share of these owners, comprising 37%, reported a growth rate ranging from 1% to 25%. However, another 29% of small business owners saw their sales revenue contract over the same period.

Small Business Owners Weigh in on Labor Shortages

19% of small business owners say they struggled to retain employees in 2019 before COVID. When looking at retention over the past two years, this percentage more than triples. 62% of small business owners say they’ve struggled to retain employees over the past few years, underlining owners’ difficulty in finding and keeping skilled workers.

When analyzing specific industries, small business owners in agriculture, consumer services, and construction have experienced the most significant obstacles in retaining employees over the past two years. Competitive pay or benefits from larger businesses, flexible scheduling, and expensive childcare are just a few reasons some industries are seeing high turnover and quit rates.

Labor shortages and employee turnover have also impacted business revenue. 43% of small business owners say they’ve lost sales revenue due to labor shortages in the past two years.

In response, small business owners are taking important steps to prevent further employee turnover. Around 45% have increased employee pay in the past two years to reduce turnover. An additional 35% of small business owners have enhanced employee benefits or perks to improve retention rates.

While labor shortages and employee retention remain significant concerns, small business owners face additional challenges. The majority of small business owners (66%) cite the rising costs of goods, materials, and services due to inflation as the biggest challenge in the past year.

As one small business owner expressed, “increased cost of goods and services, as well as increased taxes, has hit us the hardest. We have personally taken a hit on our salary to make up the difference.”

Another small business owner echoes this sentiment: “The money we earn doesn’t go as far because of inflation.”

Small Business Owners Tackle Inflation

One-third of small business owners (33%) report that inflation has significantly impacted their businesses, and 10% say it’s severely impacted their businesses. According to survey results, business owners in finance, insurance, construction, and agriculture have been impacted by inflation the most.

71% of small business owners have had to raise the prices of their products or services in response to inflation. Additionally, over half of small business owners (53%) have had to make changes to their supply chain due to inflation. These changes include sourcing alternative suppliers, renegotiating contracts, and optimizing inventory management.

Unfortunately, inflation has also forced some small business owners to make difficult choices regarding employee benefits and hours. Over a quarter of small business owners (26%) have had to cut employee benefits, perks, or hours because of rising costs.

Small Business Optimism & Business Outlook

While most small business owners remain optimistic about the future, there are still some concerns about the potential impact of a recession in 2023. One in five small business owners (21%) are not confident that their business could survive a recession this year. However, the remaining 79% of small business owners maintain some level of confidence in their businesses’ resilience.

When examining the confidence levels across different industries, small business owners in agriculture, commercial services, finance, and insurance have the most hope in their businesses’ survival during a potential recession. On the other hand, small business owners in the hospitality industry express the least confidence in their businesses’ ability to weather a potential recession in 2023.

71% of small business owners were confident in the long-term success of their businesses in 2019. In 2023, this figure dropped to 61%, indicating a 14% decline in small business owner confidence over this period.

Each State’s Small Business Employment Recovery After COVID

In the year COVID first hit (2020-2021), the United States experienced a significant net decrease in small business jobs, with a loss of 2,949,293 jobs, reflecting the severe economic repercussions of the pandemic and the challenges small businesses faced nationwide.

However, the following year (2021-2022) saw a significant recovery in small business employment. During this period, the U.S. witnessed a net increase of 5,783,811 small business jobs, indicating a net employment gain of 8.7 million jobs nationwide.

Small Business Employment Projected Growth by Trade

As the economy continues to evolve, some trades and industries should expect to experience significant employment growth, presenting opportunities for small businesses to thrive. According to the U.S. Bureau of Labor Statistics, “green” trade jobs, such as wind turbine technicians and solar photovoltaic installers, will see high growth rates over the next 10 years.

Between 2021 and 2031, wind turbine technician jobs are projected to grow by an impressive 44%, and solar photovoltaic installer jobs are projected to grow by 27%.

Closing Thoughts

In recent years, small businesses have faced unprecedented challenges brought about by the pandemic, labor shortages, and inflationary pressures. But amidst these hurdles, they’ve demonstrated their ability to bounce back, innovate, and seize new opportunities to run their businesses more efficiently.

With Coast small business fuel card, we’re helping small business owners do just that. Our easy-to-use fuel card can help small business owners with fleets easily manage their employees’ expenses and stop wasteful spending.

Methodology

To determine the state of small businesses in 2023, we surveyed 1,000 small business owners, aged 21-65, across the United States and various industries. Respondents were required to own businesses with a workforce of at least five employees and no more than 500 employees. The survey ran from May 17 to May 20, 2023, providing up-to-date insights into the experiences and perspectives of small business owners.

In addition to the survey data, we analyzed business employment dynamics data and occupational outlook data from the U.S. Bureau of Labor Statistics to show how small business employment recovered after COVID, state by state, and how certain small business trades are projected to grow over the next 10 years.